-

Solution

-

Use Cases

-

Credit Unions

Better member experiences start with confident employees.

-

Farm Credits

Create an internal Google for every employee question.

-

Banks

Better banking operations start with confident employees.

-

Contact Centers

Reduce training and escalations with better knowledge.

-

Law Firms

Empower expert staff with scalable training and support.

-

Employee Performance

Empower expert employees with Knowledge Ops.

-

Employee Training

Train and onboard faster with Find & Follow.

-

Digital Transformation

Roll out new tools and software without the headache.

-

Change Management

Adapt to changes, big and small, on the fly.

-

Internal Operations

Streamline operations with a Knowledge Ops Strategy.

-

Customer Self-Service

Turn every user into a Super User with better support.

-

Succession Planning

Don’t let operational knowledge walk out the door.

Industries

Objectives

Customer Success Stories

Learn how Knowledge Champions are succeeding with ScreenSteps.

-

Credit Unions

-

Resources

-

What is Knowledge Ops?

Learn the behaviors, tools, and teams of a Knowledge Operations Strategy.

-

What is Find & Follow?

Discover the framework that empowers expert employees.

-

Knowledge Ops Maturity Model

Evaluate your knowledge transfer strategies and learn how to level up.

-

Overview Video

See the Knowledge Ops Platform in action with 16 demo videos.

-

Weekly Webinars Register Now!

See upcoming & on-demand webinars from the ScreenSteps team.

-

User Groups

Connect and learn from other ScreenSteps users.

-

Find & Follow Book

Reduce burnout and improve performance – get your copy now!

-

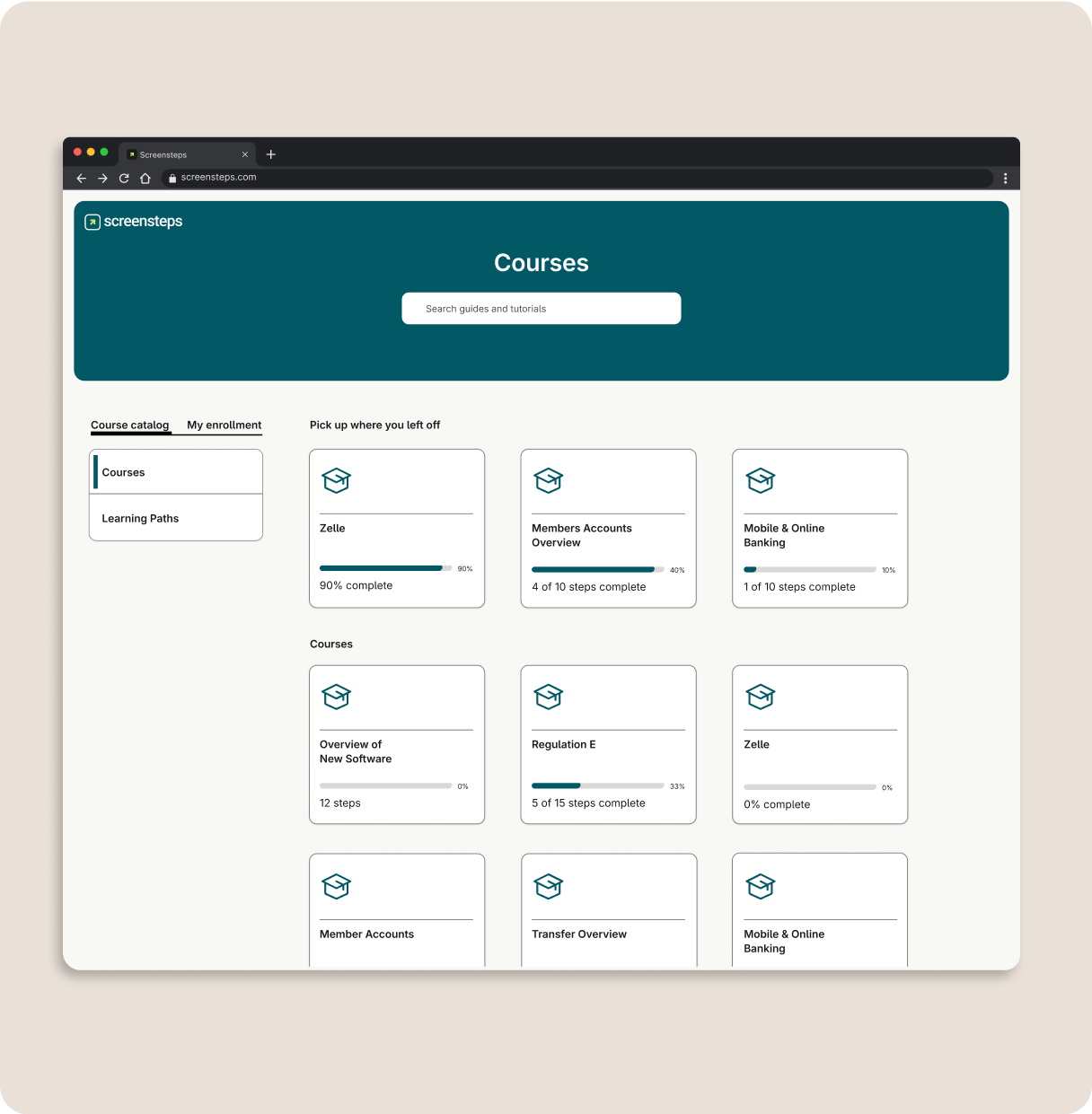

Free Courses

Enroll in courses designed to empower knowledge champions.

-

Substack

ScreenSteps CEO Greg DeVore's personal blog.

-

Learning Center

Resources to help you improve employee training & performance.

-

Blogs

Insights and tips on all things knowledge transfer.

-

Videos

Tips, tricks, and best practices from the ScreenSteps team.

-

Guides + eBooks

Deep dive into training & operational knowledge resources.

-

Partner Program

Let's transform the way teams work and train together.

Where to Start

All Resources

Find & Follow

Reduce Supervisor Burnout and Improve Employee Performance.

-

What is Knowledge Ops?

- Pricing

- About Us

.png)